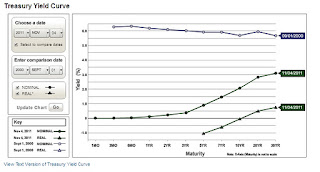

I am using the Treasury yield curve data visualization web page that the Treasury Department provides, and I have found something rather interesting. You can often get an idea what the future holds by looking at Treasury yield curves (yield plotted against maturity). I decided to see if there was a date in the past when the yield curve had the same shape as today--and I found an interesting match:

The yields are a good solid point below where they were in 2003, but it does seem like we could be getting ready for a pretty remarkable boom.

UPDATE: A reader asked a question in the comment. A little clarification of my thought processes:

A steep yield curve can mean either inflation is coming, or an economic recovery that is going to drive up interest rates. It is not that rising interest rates cause the boom, but that a boom will cause rising interest rates. That has been the historical significance of a yield curve like that. Compare to the yield curves for a couple of other dates when the economy was in deep trouble:

For a bond investor, the current yield curve says to not buy long-term bonds right now. Buy stocks instead, sell them when almost everyone is talking about how there is nowhere for the stock market to go but up, and buy long-term bonds with the proceeds.

Conservative. Idaho. Software engineer. Historian. Trying to prevent Idiocracy from becoming a documentary.

Email complaints/requests about copyright infringement to clayton @ claytoncramer.com. Reminder: the last copyright troll that bothered me went bankrupt.

Sunday, November 6, 2011

Interesting Treasury Yield Curve Similarities

Subscribe to:

Post Comments (Atom)

Why would rising interest rates set the state for "a pretty remarkable boom"? Rising interest rates signify falling asset prices. Now if you mean some kind of storm before the silver lining, in which asset price bubbles burst, asset valuations plummet, and then a "boom" begins from the bottom of the pit we've fallen into, well, then okay.

ReplyDeleteAlso, rising yield curves are possibly a sign of expected inflation. Surely you wouldn't consider inflation in asset values a boom worth wishing for, would you?

Note that from the standpoint of bond investor, you should wish for falling interest rates. That will yield you an unanticipated capital gain, in addition to the yield you expected at the time of purchase. But if interest rates rise, and you have to sell before maturity, you will take a loss.

Thanks for the updated explanation. It makes sense, in a contrarian sort of way.

ReplyDelete